All Categories

Featured

Table of Contents

Trustees can be family members, trusted individuals, or monetary organizations, depending on your preferences and the complexity of the trust. The objective is to ensure that the trust is well-funded to meet the kid's lasting financial needs.

The role of a in a child assistance trust fund can not be understated. The trustee is the specific or company in charge of managing the count on's possessions and ensuring that funds are distributed according to the terms of the trust fund agreement. This includes making sure that funds are used solely for the child's benefit whether that's for education, treatment, or day-to-day expenses.

They must additionally give normal records to the court, the custodial moms and dad, or both, depending upon the terms of the count on. This responsibility makes certain that the count on is being handled in a manner that benefits the youngster, protecting against abuse of the funds. The trustee additionally has a fiduciary duty, indicating they are legitimately obliged to act in the most effective rate of interest of the child.

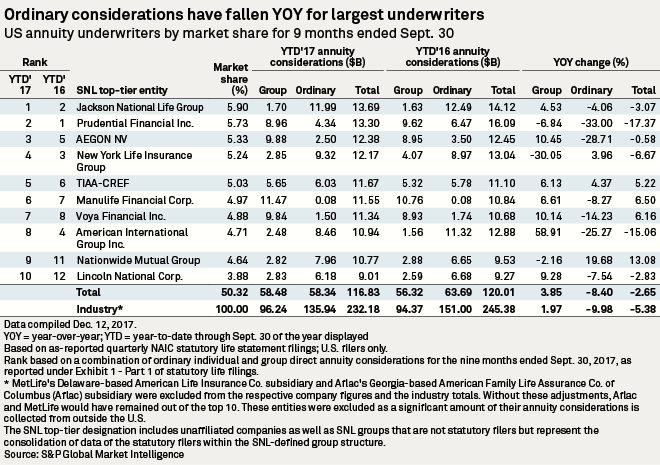

By purchasing an annuity, moms and dads can guarantee that a dealt with quantity is paid out on a regular basis, regardless of any fluctuations in their earnings. This gives comfort, knowing that the child's needs will continue to be satisfied, no matter the monetary scenarios. Among the crucial benefits of utilizing annuities for youngster support is that they can bypass the probate process.

Where can I buy affordable Annuity Investment?

Annuities can likewise provide security from market fluctuations, ensuring that the child's financial backing continues to be secure also in volatile economic problems. Annuities for Kid Support: A Structured Remedy When establishing, it's vital to take into consideration the tax ramifications for both the paying parent and the kid. Counts on, depending upon their structure, can have different tax treatments.

While annuities offer a steady income stream, it's vital to recognize exactly how that earnings will certainly be tired. Depending on the structure of the annuity, payments to the custodial moms and dad or kid may be taken into consideration taxed income.

Among the most substantial advantages of making use of is the capacity to protect a youngster's financial future. Trust funds, particularly, use a degree of security from financial institutions and can make certain that funds are made use of sensibly. For example, a depend on can be structured to ensure that funds are only used for particular functions, such as education and learning or healthcare, protecting against misuse - Tax-deferred annuities.

Who should consider buying an Senior Annuities?

No, a Texas child support trust fund is specifically designed to cover the child's important demands, such as education, medical care, and daily living expenditures. The trustee is legally bound to make certain that the funds are made use of exclusively for the benefit of the youngster as detailed in the trust contract. An annuity offers structured, predictable repayments with time, ensuring constant financial support for the child.

Yes, both youngster assistance trust funds and annuities included prospective tax obligation ramifications. Trust fund revenue might be taxable, and annuity repayments might likewise go through taxes, depending on their framework. It is essential to seek advice from a tax professional or monetary expert to comprehend the tax obligation duties associated with these economic tools.

Annuities

Download this PDF - View all Publications The senior population is big, expanding, and by some price quotes, hold two-thirds of the individual wealth in the USA. By the year 2050, the number of elders is forecasted to be virtually twice as big as it was in 2012. Because lots of senior citizens have been able to save up a savings for their retired life years, they are commonly targeted with fraud in such a way that younger individuals with no savings are not.

The Attorney General provides the following suggestions to consider before purchasing an annuity: Annuities are challenging investments. Annuities can be structured as variable annuities, taken care of annuities, prompt annuities, postponed annuities, and so on.

Customers need to review and recognize the program, and the volatility of each investment noted in the prospectus. Financiers should ask their broker to clarify all terms and problems in the syllabus, and ask questions regarding anything they do not recognize. Repaired annuity items might additionally lug risks, such as long-term deferral durations, preventing capitalists from accessing all of their cash.

The Lawyer General has submitted suits versus insurance firms that offered inappropriate postponed annuities with over 15 year deferral periods to financiers not anticipated to live that long, or that need accessibility to their cash for wellness treatment or assisted living expenditures (Immediate annuities). Investors need to make sure they know the long-term consequences of any kind of annuity acquisition

What should I look for in an Retirement Income From Annuities plan?

Be careful of seminars that supply complimentary dishes or gifts. In the long run, they are rarely free. Be careful of representatives that provide themselves phony titles to improve their integrity. The most substantial charge associated with annuities is usually the surrender cost. This is the percent that a customer is charged if he or she takes out funds early.

Consumers may desire to speak with a tax obligation consultant before spending in an annuity. The "safety and security" of the financial investment depends on the annuity.

Agents and insurance coverage business might offer bonuses to lure investors, such as additional interest points on their return. Some unscrupulous agents urge consumers to make unrealistic financial investments they can not manage, or get a lasting deferred annuity, even though they will certainly require access to their cash for health and wellness treatment or living expenses.

This section supplies information helpful to retired people and their families. There are several celebrations that might affect your advantages. Supplies information frequently asked for by brand-new retired people including altering health and life insurance policy choices, COLAs, annuity payments, and taxed portions of annuity. Explains just how benefits are affected by occasions such as marital relationship, separation, death of a spouse, re-employment in Federal service, or failure to manage one's finances.

What is an Variable Annuities?

Key Takeaways The beneficiary of an annuity is an individual or company the annuity's proprietor marks to get the contract's survivor benefit. Different annuities pay out to recipients in different ways. Some annuities may pay the beneficiary steady repayments after the contract holder's death, while other annuities may pay a survivor benefit as a round figure.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options Key Insights on Fixed Vs Variable Annuity Pros And Cons Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Fixed Vs Vari

Understanding Financial Strategies A Comprehensive Guide to Fixed Income Annuity Vs Variable Growth Annuity Defining Annuity Fixed Vs Variable Advantages and Disadvantages of What Is A Variable Annuit

Understanding Fixed Interest Annuity Vs Variable Investment Annuity A Closer Look at Fixed Interest Annuity Vs Variable Investment Annuity Breaking Down the Basics of Fixed Annuity Vs Equity-linked Va

More

Latest Posts